August 1, 2023

Signet Financial Management was featured in the Financial Advisor Magazine’s America’s Top RIAs ranking in July 2023.

April 15, 2024

Steve Tuttle explains how combining index funds, active strategies, and a multi-factor approach can enhance returns and align with your risk tolerance for a robust portfolio.

April 11, 2024

The tax deadline is coming up, but IRA contributions, funding your HSA and itemizing your deductions can all lead to lower tax burdens.

April 1, 2024

February job growth exceeds expectations, signaling economic strength amid inflation. Learn how it affects Fed rate plans and what investors should do about it.

April 1, 2024

Explore the risks of overexposure to large-cap stocks and the benefits of alternative investing strategies for a diversified portfolio.

March 28, 2024

Delve into the factors that affect your Social Security retirement benefits, including the significance of your earning history and the advantages of delaying benefits until age 70…

March 21, 2024

Effective retirement health planning requires understanding Medicare’s coverage limits. Get insights into preparing for out-of-pocket costs and supplemental insurance needs.

March 14, 2024

Learn the key differences in retirement planning between men and women, focusing on longevity, income gaps, Social Security benefits, and investment strategies.

March 4, 2024

Stay informed on key economic updates: January’s inflation spike, the Fed’s monetary policy, global GDP growth, and S&P 500 earnings highlights.

February 29, 2024

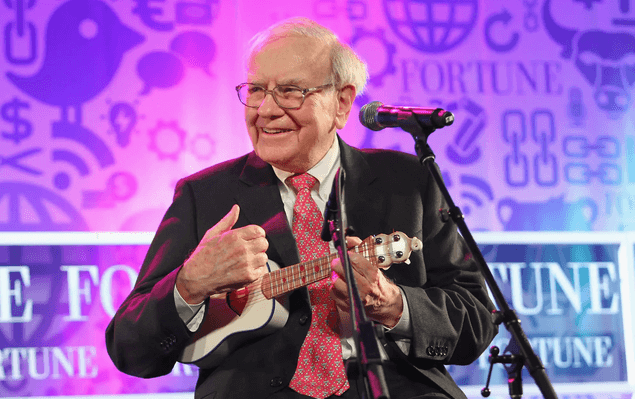

Learn investment insights from Warren Buffett’s 2024 Berkshire Hathaway letter, highlighting the importance of clarity, patience, and fiscal prudence for success.

February 22, 2024

Learn how IRA and Roth IRA transactions impact your taxes. Understand non-taxable investments, tax consequences of withdrawals, and how to navigate capital gains and penalties effi…

February 15, 2024

Maximize your 2023 tax return with tax deductions you might overlook! Charitable contributions, state taxes and healthcare expenses could lower your tax bill.

February 1, 2024

U.S. economy grows 3.1% in 2023, defying recession fears with a robust labor market fueling consumer spending. Explore insights on inflation, Fed policies, and the 2024 economic ou…

February 1, 2024

Explore how structured notes can stabilize your investment portfolio amidst market volatility. Learn their benefits for a balanced approach to wealth creation.

January 25, 2024

Prevent retirement bummers with smart planning. Discover strategies to maximize your retirement income through Social Security, savings, and work scenarios.

January 18, 2024

With more than a quarter of U.S. adults living with a disability and needing insurance, the industry offers a number of options.

January 11, 2024

Navigate 2024’s 401(k) changes: increased contribution limits, new IRS regulations, and tips for optimizing your retirement contributions and savings plans.

January 4, 2024

Maximize your investment returns with tax-efficient strategies. Learn how to manage capital gains, utilize retirement accounts, and understand investment taxes for smarter planning…

December 28, 2023

Get ahead in 2024 with insights on the January Effect. Learn how this perceived stock market anomaly may influence your trading decisions in the new year.

December 26, 2023

Strategies to boost your retirement savings, optimize taxes, and review your spending to ensure a smooth transition into the new year.

December 21, 2023

Understand the key differences between home health care and home care in Medicare coverage. Learn about eligibility, earnings limitations, and how to access the right services.

December 19, 2023

Learn how using QTIP trusts can help wealthy Americans in second marriages balance new spouses and previous children’s needs.

December 14, 2023

Here’s what to focus on to ensure your small business finishes the year strong and is prepared for the upcoming year.

December 12, 2023

Explore how claiming Social Security before full retirement age affects your benefits, including reductions, earnings limits, and how withheld benefits are recalculated later.

December 5, 2023

Navigate stock market fluctuations with confidence. Embrace long-term strategies, diversify with bonds, and understand the power of a well-balanced investment portfolio.

December 1, 2023

Prepare for 2024 with our market projections: economic forecasts, interest rate impacts, and investment strategies for balancing your portfolio in the upcoming year.

November 29, 2023

Explore how structured notes can amplify the performance of your 60/40 portfolio. Understand their role in risk management and potential for higher returns in your investment mix.

November 28, 2023

Considering joint or separate tax filings? Learn about potential liabilities, innocent spouse relief, and how marital status affects your taxes.

November 21, 2023

Enjoy Black Friday benefits without compromising financial stability. Check out these tips for smart shopping during sales.

November 16, 2023

Explore tax-loss harvesting as a smart end-of-year financial strategy to lower your taxes on investment gains.

November 14, 2023

The impact of Black Friday and Thanksgiving is modest, but there are some changes you should be aware of.

November 9, 2023

Diversify beyond stocks and bonds with private markets. Discover long-term growth with private credit and infrastructure.

November 1, 2023

Considering investing in bonds? Discover why current interest rate conditions might make now the ideal moment.

November 1, 2023

Strong start to Q3 earnings season, with major banks exceeding forecasts. However, the current financial landscape presents challenges, particularly with the bear steepening of the…

October 31, 2023

Market sentiment: an emotion-driven compass of financial markets. Understand its definition, types of indicators, and the role it plays in price movements.

October 19, 2023

Understand how H.S.A.s differ from F.S.A.s and the unique tax benefits they offer. Learn how to optimize your savings for current and future medical expenses.

October 17, 2023

Retirement planning for women is evolving. While challenges persist — from the pay gap to financial confidence — learn strategies to fortify your financial future.

October 12, 2023

An emergency fund isn’t just for emergencies. Learn how it can make home buying, moving, and traveling more manageable.

October 11, 2023

Let’s explore some of the key areas to incorporate into your decision-making so you make the most informed choice based on your expected needs.

October 2, 2023

The U.S. inflation situation remains uncertain, with the potential for another rate hike. Read how Signet adjusts portfolio strategies to navigate this intricate landscape.

October 2, 2023

Historically, the fourth quarter offers strong stock market returns. With signs of a potential rebound and support levels, cautious optimism prevails for a favorable end to 2023.

September 28, 2023

A sound, long-term financial plan is the best way to protect your finances from stagflation. Learn how to adjust your investment strategy during economic uncertainty.

September 26, 2023

Discover the 2026 changes to 401(k) catch-up contributions under the SECURE 2.0 Act. How will it affect your taxes and retirement savings?

September 21, 2023

Curious about the cost of retiring in the US? Explore the factors that affect retirement costs and find out the top states for retirement based on the Investopedia Retirement Index…

September 19, 2023

Don’t let the fear of a recession drive you to make hasty financial decisions. Check out some common mistakes people make before recessions that can hurt their finances.

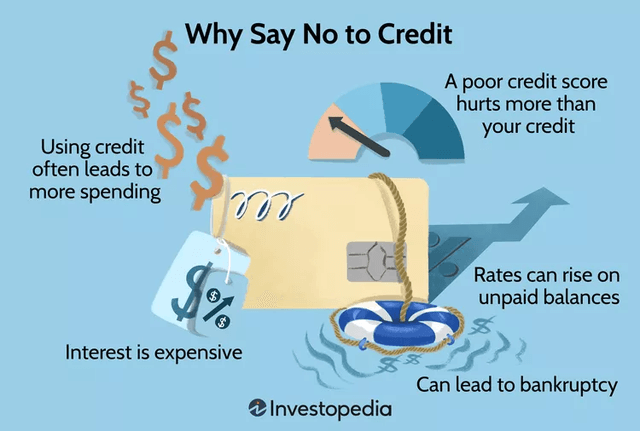

September 12, 2023

Credit cards can be a financial lifeline, but they can also lead to disaster if not managed wisely. Learn to avoid overspending, high interest, and credit score damage.

September 7, 2023

Are you in a dual-career couple with an age gap? Explore retirement planning tips, including Social Security, healthcare, and financial strategies, to secure your financial future.

September 5, 2023

The U.S. inflation situation remains uncertain, with the potential for another rate hike. Read how Signet adjusts portfolio strategies to navigate this intricate landscape.

August 31, 2023

Learn how open communication can prevent loss of assets and familial trust, ensuring a smooth transition for the next generation.

August 29, 2023

Learn how women’s investment strategies differ. Explore key research findings on gender and investment decisions.

August 24, 2023

Preparing for divorce? Learn effective strategies to protect your personal credit . Discover how to close joint accounts, freeze credit, and monitor your score.

August 22, 2023

Childhood money lessons don’t always stick, but here’s how parents can introduce kids to saving and compound interest.

August 17, 2023

Inflation is still around, a possible recession, rising interest rates and geopolitical tensions are all reasons you should think about protecting your portfolio.

August 15, 2023

Inheriting money or assets? Discover how to invest your inheritance wisely. Learn about cash, retirement accounts, investments, properties, and businesses.

August 11, 2023

Want to support your grandkids without sacrificing retirement savings? Learn 8 smart ways, from 529 plans to trusts.

August 1, 2023

Learn about Signet’s approach to investing in dividend stocks. Discover a better way to build a diversified portfolio for steady income!

August 1, 2023

The US economy shows positive signs with cooling inflation, boosting equities. With a strong consumer and solid job market, fears of a recession lessen.

July 27, 2023

Avoid unnecessary bank fees! Learn how to steer clear of account maintenance, ATM, overdraft, and other charges. Save money with savvy banking.

July 25, 2023

Dealing with IRS tax debt? Discover your options — setting up an IRS payment plan or using a personal loan. Compare pros and cons to make an informed decision.

July 20, 2023

Discover the key divorce mistakes to avoid for a smoother post-settlement journey. Learn how to navigate lifestyle, tax, home, legal, and insurance challenges wisely.

July 18, 2023

Explore the growing trend of semi-retirement. Learn about tax implications and other considerations to make informed decisions about your retirement plan.

July 13, 2023

Discover crucial financial tips for young adults to build a healthy future. Learn about budgeting, saving for retirement, taxes, and more.

July 11, 2023

Discover how understanding investor psychology and market patterns can lead to superior investment returns. Learn the key lessons for taking the temperature of markets.

July 6, 2023

Explore the dynamics of the US economy, inflation, and the impending Fed’s rate hike decision, alongside the potential impact of AI on the economy.

June 29, 2023

Discover how to achieve financial freedom and overcome the struggles of limited financial security. Celebrate independence by taking steps towards a brighter financial future.

June 27, 2023

Tim Denning, ex-banker, shares tips on changing poor money mindset that may keep you stuck. Here are a few money habits keeping you poor.

June 22, 2023

Consider the cost and hassle of maintaining a second home from afar plus your desire to travel to other destinations before buying a vacation home.

June 20, 2023

Uncover the factors influencing perceptions of wealth in America. Check out the survey findings that reveal what it truly means to feel rich.

June 15, 2023

Whether a locked or changing rate is better depends on where the Fed rate is headed. Uncover the pros and cons of each and make informed decisions.

June 13, 2023

Summer is an ideal time to reassess your financial goals and make necessary adjustments to stay on track. Explore 9 financial steps for your mid-year financial checkup.

June 8, 2023

A regret-free retirement requires several years of planning, budgeting, putting money aside, and staying the course.

June 2, 2023

Earnings season proved better than expected. Inflation slowed. The Fed may be done with rate hikes. Read how Signet is positioning portfolios for the latest market developments and…

June 1, 2023

While every retirement is unique, these are some observations about what retirement issues should be prioritized and what can be delayed.

May 30, 2023

Discover the ins and outs of 401(k) plans and employer matches. Learn about contribution limits, investment options, and how to maximize your retirement savings.

May 25, 2023

The US debt ceiling battle is heating up, and it could have serious implications for your finances. Stay informed to navigate uncertain times with confidence.

May 23, 2023

Should you hold cash or invest in the market? Attractive yields on savings and cash-like investments can make it tempting to hold cash instead of investing extra money.

May 18, 2023

Pay attention to these changes brought about by the Secure Act 2.0 because they could have a profound effect on your retirement plans.

May 16, 2023

The US SSA made some important changes that could impact your retirement plan. Learn about the 8.7% increase in Social Security benefits, higher income thresholds, and more!

May 11, 2023

Here’s how to fix your budget if you want to be great with money, stop stressing about finances, and be able to claim financial freedom some day.

May 9, 2023

QPRTs are a fairly simple way for the rich to save on taxes and keep homes in the family. However, there are a few strings attached.

May 4, 2023

Learn more about why banks fail, how FDIC insurance works to help you recoup your money, and how to protect your finances.

May 1, 2023

Earnings season is underway, and investors are watching closely. Find out what the latest economic data mean and how stocks are holding up against inflation

April 27, 2023

You’re not bad at money management. You need a better decision-making process that won’t leave you feeling exhausted and overwhelmed.

April 25, 2023

There are quite a few recurring myths that could be hurting your ability to plan properly for retirement. Here are 10 heard most often.

April 20, 2023

Will inflation subside to ultra-low pre-Covid levels or will it be a lasting problem, as in the 1970s and early 1980s? What will happen to interest rates?

April 18, 2023

With tax season in the rearview mirror, it’s a great time to give your finances a once-over. Start with these steps.

April 13, 2023

The key to retiring with no savings is to be resourceful and creative. Here are some ideas to consider.

April 11, 2023

A recent study showed that 58% of business owners lacked a succession plan. Consider these key elements to get yours on the right track.

April 6, 2023

It’s important to understand how marriage affects your taxes. Avoid any potential surprises with these essential tips for filing taxes as a newlywed.

April 4, 2023

Eugene Yashin gives a comprehensive analysis of the current economic landscape and shares a macro look at the banking crisis and its implications for the markets.

March 30, 2023

In 2022 philanthropy became a sustaining force for nonprofits despite economic pressures. Here are five lessons from last year that can shape individual giving in 2023.

March 28, 2023

Many audits are triggered by actions taxpayers themselves have taken. Here’s a list of red flags that can cause your tax return to be targeted by the IRS for review.

March 23, 2023

During the estate administration process, it is easy to see where the decedent veered off course. Often the fix was inexpensive and could have saved their heirs in legal fees.

March 21, 2023

The collapse of three US regional banks and the Credit Suisse selloff are drawing comparisons to the great financial crisis of 2008. We believe 2023 is different. Here’s why.

March 16, 2023

The FDIC and other entities will protect most people’s bank and brokerage balances. But having a few backup plans is just good financial hygiene.

March 14, 2023

Silicon Valley Bank’s collapse highlights the dangers of being overly exposed to high-risk sectors. Investors can learn from Buffett and Lynch in such events.

March 9, 2023

Most business owners will not receive a refund from the IRS. Apply these 3 tips to help minimize what you owe at tax time.

March 6, 2023

Despite the short-term softening of corporate profit data, we should expect the stock market and growth rates to start advancing even amidst a recession.

March 2, 2023

Short-term volatility should always be expected, but long-term investors have several reasons to be optimistic about the market outlook.

February 28, 2023

The rules for inherited IRAs are complex. Understanding those rules is crucial to getting the most out of the inherited IRA — and avoiding running afoul of the IRS.

February 23, 2023

Choosing to relocate to another state is a complicated and very personal decision. If you’re thinking about retiring in a different state, read these valuable tips first.

Watch video

Watch video

Watch video

Watch video